After many months of studying, I am very excited to share that I have passed the #CFA L2 examination today.

Preface

As I mentioned in my reflection on the CFA Level 1 exam, my background is in engineering, and my daily work primarily involves software development. Despite not coming from a finance-related field, I managed to pass Level 1 after a year of dedicated preparation. With that accomplishment — and having gained some financial knowledge through running my own company — I decided to continue my journey and take on the challenge of Level 2, even as a newcomer to the world of finance.

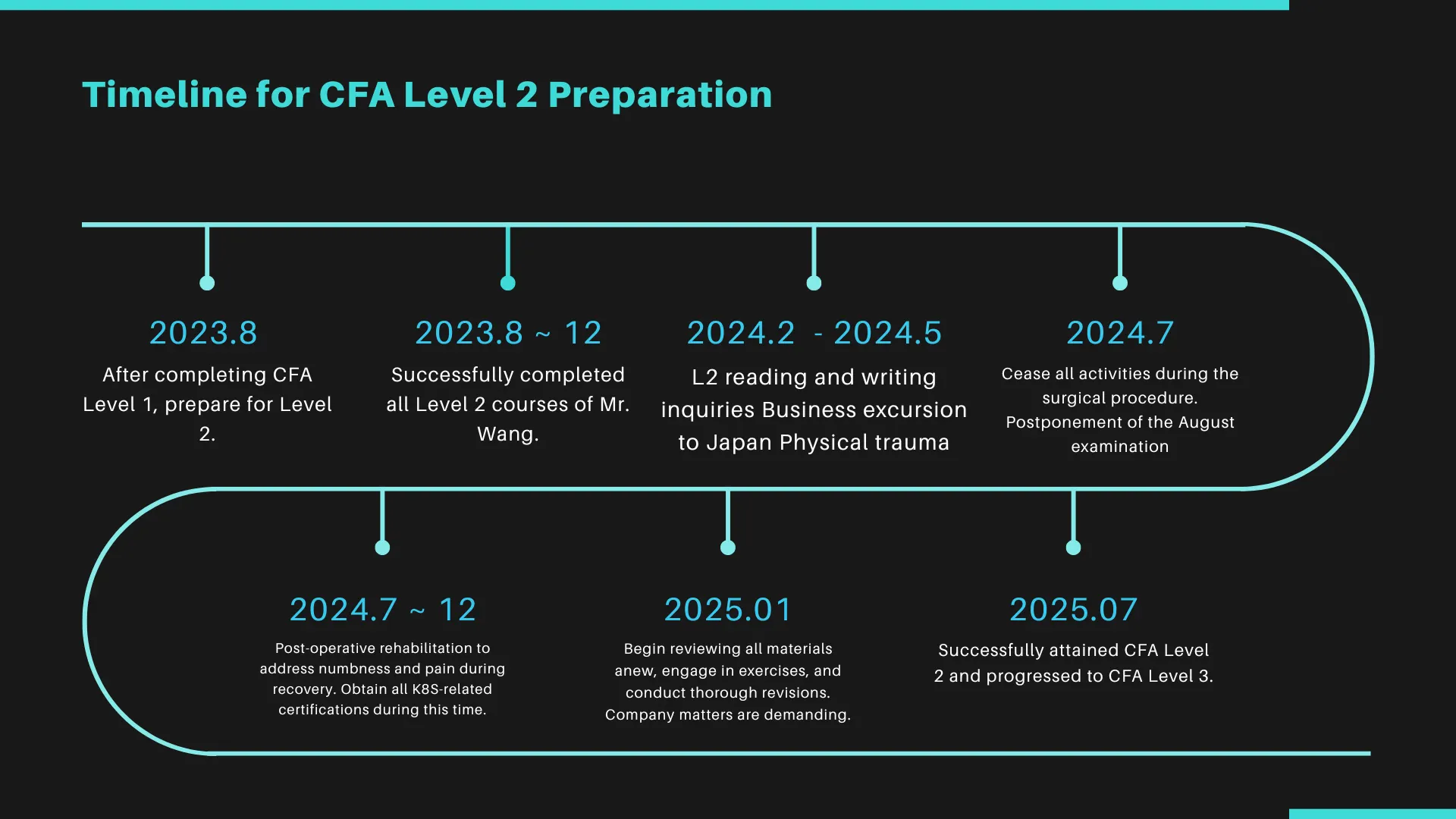

After completing the Level 1 exam in August 2023, I immediately transitioned into preparing for Level 2. During this time, I had multiple discussions with my instructors to refine my study strategy and ensure I was in the best possible shape for the exam.

You might wonder: if I started preparing for Level 2 in August 2023, why did I not sit for the exam until May 2025? The answer lies in an unexpected health issue I encountered in 2024. I had to undergo emergency surgery, which made it impossible for me to attend the originally scheduled exam. By the time I recovered, the November 2024 session was already fully booked. As a result, the earliest available date I could register for was May 2025.

In this article, I will also share the process of how I requested a deferral from the CFA Institute, what the waiting period and outcome were like, and how I navigated the emotional and practical challenges of adjusting my study plan. I hope my experience can offer some guidance and reassurance to those of you who are preparing for the exam or facing similar setbacks.

Study Approach

There is one crucial point I urge you to keep in mind: before diving into CFA Level 2 preparation, it is essential to thoroughly review and truly understand the content from Level 1. This is especially important if you didn’t devote enough time or follow a structured approach during your Level 1 studies.

Many Level 2 materials skip over fundamental explanations of certain concepts because the CFA Institute assumes you’re already familiar with them from Level 1. In other words, these concepts are treated as foundational knowledge and are rarely — if ever — reviewed in depth again.

So, if you realize that much of your Level 1 knowledge has faded, I strongly recommend setting aside at least one month for a systematic review of all the core Level 1 topics. During this period, you can also apply what I’ll describe later as “Preparation Tip #1”, to ensure you’re not just rereading the material, but truly understanding it and laying a solid foundation for Level 2.

Just like I did for Level 1, I chose to continue my studies for Level 2 with Professor Xiang Wang’s course. At the time, the 2024 CFA curriculum had just undergone significant changes, and with my workdays often exceeding 12 hours, managing my study time effectively became more critical than ever. The structured materials provided by the course, along with the professor’s clear and methodical explanations, helped me quickly grasp the overarching framework within a limited time. Not only did I understand the details, but I also saw the bigger picture — gaining a clearer sense of the core concepts the CFA Level 2 exam expects us to master. The lecture recordings, in particular, were invaluable for repeated review and deeper absorption.

Overall, my study resources were intentionally kept minimal and focused. Aside from Professor Wang’s course materials, I relied solely on the official CFA curriculum and the CFA Institute’s question bank. I didn’t purchase any additional prep books or third-party question banks — I made a deliberate choice to stay focused on the official content and course instruction.

If Level 1 paints a broad blueprint for newcomers to the finance world, then Level 2 is a deep dive into the world of valuation — including equity valuation, bond pricing, corporate value assessment, and even the logic behind real estate appraisal. I used to find analysts’ price targets for stocks difficult to decipher, but it wasn’t until I studied Level 2 that I began to truly understand the frameworks and theoretical foundations behind those valuations.

In my Level 1 reflection, I shared some foundational study techniques. However, the increased complexity and volume of material in Level 2 pushed me to further refine and optimize my approach. Especially in 2023, with the rapid rise of generative AI, I began leveraging these tools to boost my learning efficiency and output under intense time constraints.

In the next section, I’ll share several practical techniques I used — hoping they’ll provide you with helpful strategies for your own journey.

During my Level 2 preparation, I not only built upon the foundation I established in Level 1 but also adopted more structured strategies to deepen my understanding and improve retention. Specifically, I created mind maps to synthesize key points across chapters, reorganized my study schedule with clear timelines, and managed my progress more intentionally. I also revisited a personal SWOT analysis to assess my strengths and weaknesses, allowing me to focus on areas that required targeted improvement.

For subject-specific study strategies, I followed the guidance provided by Professor Xiang Wang during his lectures. His insights aligned closely with the CFA Institute’s expectations — certain topics consistently receive greater emphasis, and his course helped prioritize these effectively.

When it came to reviewing mistakes, I took a differential analysis approach. Instead of merely recording the correct answers, I focused on understanding the root of each mistake — why I got it wrong, what the misconception was, and how to avoid repeating it. This method not only reinforced the correct concepts but also sharpened my critical thinking and exam instincts.

In the following section, I’ll dive deeper into the actual techniques and tools I used throughout my study journey. I hope these practical insights will offer useful guidance and inspiration for your own preparation.

Study Techniques

Mastering Logical Reading in English

For many Taiwanese candidates, reading comprehension remains one of the toughest challenges when preparing for English-based exams. This is especially true for CFA Level 2, where questions often begin with a concise yet information-dense vignette. Candidates are expected to quickly grasp the scenario and select the correct answer — placing a high demand on one’s ability to process English logic and structure efficiently.

I’ve shared more details about how I personally trained this skill in a separate article on English reading comprehension. Feel free to check it out if you’re looking for more guidance.

Of course, there are many ways to improve your English reading skills. Aside from my own methods, one of the most fundamental and effective approaches is extensive reading of English materials. By continuously exposing yourself to native texts, you’ll gradually reduce the sense of unfamiliarity and begin to internalize sentence structures and logical flow — ultimately helping you read with greater ease and confidence under exam conditions.

Teach It Like a Teacher

This is a strategy I began applying in early 2025. It came from a realization during the early stages of my Level 2 prep: the exam scope was incredibly broad, and it was easy to get lost in the technical details — especially when it came to formulas, accounting standards, and valuation methods.

But then I thought: if I were a teacher or a professional explaining these concepts to a client, I wouldn’t be able to use “It’s too hard” or “There’s just too much to cover” as an excuse. That’s when I began putting myself into the role of an instructor — someone who must explain each concept clearly, logically, and correctly to others.

A practical way to do this is by writing out each concept in your own words on paper, then reviewing what you wrote to see whether it’s accurate and logically sound. This becomes a powerful form of self-validation and output training.

An added bonus: those written explanations become personalized, high-impact notes you can review before the exam. I jokingly call this method the “Teacher’s Notebook Technique” (not an official term, of course).

Clean & Redo: Resetting for Deeper Learning

In the early stages of preparing for CFA Level 2, many candidates — myself included — experience a significant sense of frustration. Compared to Level 1, the question format in Level 2 is a major shift. Level 1 questions are typically short and straightforward, often just a single sentence followed by three answer choices. As long as you’ve attended the lectures and grasped the basic concepts, you can usually maintain a decent accuracy rate.

Level 2, however, presents its first major challenge in the form of increased reading complexity. Questions evolve from brief statements to lengthy, scenario-based vignettes. In particular, the official CFA question bank features long-form case studies, each followed by multiple questions. The reading load and difficulty of comprehension rise sharply. Many questions require you to refer back to specific paragraphs, and it’s common in the beginning to feel completely lost — wondering which part of the text the question is referring to.

The second challenge is the gap between understanding and execution. Even after completing a lecture, many candidates find themselves unable to answer questions. Common reasons include:

- Forgetting the structure of a specific valuation formula

- Not knowing which formula to apply in a given context

- Misunderstanding a concept, leading to the wrong calculation approach

To overcome these issues, I adopted a strategy of repeated practice and resetting the question environment. I did nearly all my practice using the CFA computer-based question system, and after completing each chapter or mock exam, I would reset the entire quiz and redo it from scratch. During the final stretch before the exam, I made a habit of resetting and retaking full mock exams every 2–3 days, reinforcing both familiarity and application skills.

Throughout this process, I rarely used printed materials. I only switched to paper when I needed to rest my eyes or when I was too mentally drained and wanted to lower the barrier to studying — using printed questions for a quick scan or casual review. It’s worth noting that the CFA official question bank presents each vignette as a full-length passage followed by multiple questions. At first, this format can feel overwhelming, with a flood of information and no clear indication of which paragraph to focus on. That’s why consistent repetition and controlled pacing in practice are absolutely essential.

As I entered the later stages of preparation, I experimented with more flexible — but still effective — review techniques. One of my go-to methods was printing out practice questions from the textbook and converting them into fill-in-the-blank exercises. Compared to rewriting full answers from scratch, this method felt lighter, but still required serious thinking — “Which formula goes here?” or “What concept applies in this context?” It struck a perfect balance between low burden and high efficiency.

I also organized these fill-in-the-blank sheets and brought them with me to the exam center. During the mid-session break, flipping through these personalized notes helped me quickly recall key concepts and also served as a way to calm my nerves, keeping me focused and mentally aligned for the second half of the exam.

Collaborating with Generative AI

During my Level 2 preparation, I also began using AI as a support tool, primarily for translation. Some of the materials and question prompts were quite lengthy, and reading them in English under time constraints could be taxing. By translating them into Chinese, I was able to more quickly grasp the key points and logical flow.

That said, I was also fully aware of AI’s limitations, especially the issue of hallucinations — such as mistranslations, omissions, or even entirely fabricated content. To avoid misunderstandings, I always cross-checked the AI-generated translation against the original English, verifying both accuracy and completeness.

Interestingly, this review process became a powerful learning tool in itself. Whenever I caught an incorrect translation — whether it was a misused concept or a poorly interpreted term — I paid closer attention to it, which helped solidify the correct meaning in my mind. In this way, combining AI assistance with active review unexpectedly became one of the most effective memory techniques in my study toolkit.

Don’t Rush into Question Drilling

If you’re someone who’s used to taking certification exams and aiming for fast-track success, you might be inclined to rely on heavy question drilling and reverse-engineering the test to identify key topics — perhaps even trying to predict the examiners’ preferences. For CFA Level 1, that approach might still work to some extent. Most questions there focus on testing basic concepts, and with enough repetition, you can start to recognize common patterns and directions.

However, this strategy quickly loses effectiveness at Level 2. First, the question format shifts from single-sentence prompts to lengthy, scenario-based vignettes. These aren’t simply testing one concept at a time. Instead, you’ll need to read and process a significant amount of information, determine what the question is truly asking, and decide which formula or valuation framework to apply. It challenges your comprehension, reasoning, and memory all at once.

Second, Level 2 emphasizes the application of concepts and the logic behind your answers. Mistakes often don’t come from misapplying a formula, but from misunderstanding the underlying scenario or misinterpreting the context — causing your entire line of reasoning to go off course. This can lead to repeated errors and a draining sense of discouragement that erodes motivation over time.

That’s why I strongly recommend adopting a textbook-centered deep learning strategy for Level 2. Rather than rushing through endless questions, go back to the core materials: work through the examples in the textbook, read the Learning Outcome Statements (LOS) multiple times, and build your understanding from the foundational concepts upward. While this may feel slower than brute-force question drilling, it results in deeper comprehension and stronger long-term retention.

For example, equity valuation was my weakest area. I often got the Terminal Value calculation wrong — either forgetting key steps or confusing the logic entirely. But instead of skipping ahead, I practiced similar question types seven to ten times, gradually untangling the relationships between present value and terminal value. Eventually, I gained a clear understanding and could apply the valuation concepts with confidence.

Preparing for the Exam After a Deferral

Eligibility and Costs of Postponement

This section is especially for those who may be facing a deferral of their CFA exam.

If you’re considering a deferral simply because you don’t feel ready, I urge you to think carefully. The CFA Institute has published data showing that the pass rate for deferred candidates is only around 35%. Their analysis suggests that many candidates defer due to lack of preparation — but fail to meaningfully improve their readiness during the extended time, leading to disappointing results. So if your decision to defer is driven purely by anxiety, it may actually trap you in a longer cycle of procrastination.

That said, life is unpredictable, and sometimes deferring the exam truly is the only option. That was certainly the case for me.

After returning to Taiwan from a business trip in May 2024, I began experiencing severe lower back pain — so intense that even walking became a struggle. Within just two minutes of walking, I would develop intermittent claudication, making it difficult to move around normally. For the entire months of May and June, I found myself constantly going back and forth between hospitals and clinics.

At first, I assumed it was simply fatigue or a muscle strain. However, after undergoing an MRI in June and following up at the end of the month, I was shocked to learn that the condition was far more serious — a compressed nerve was causing the pain, and my doctor suspected that surgery might be necessary. On July 2, after a detailed consultation, surgery was officially recommended.

Naturally, my first thoughts were about my health — but immediately afterward came a wave of disbelief:

“What about the exam?”

I couldn’t believe things had escalated to the point of needing surgery.

I underwent the operation on July 15, 2024, and during my hospital stay, one moment remains especially vivid: I was still lying in bed, listening to CFA Level 2 lecture recordings… and eventually drifted off to sleep with them playing in the background (laughs).

Unfortunately, my doctor advised that during the recovery period, I should not remain seated for more than 20 minutes at a time, and this restriction would last for at least three months. Under such conditions, it was clear I would be unable to take the exam as originally planned. I had no choice but to request a deferral from the CFA Institute. (You can find more about CFA’s exam deferral policy [here].)

The CFA Institute has a clear and structured policy for exam deferrals. If you’re requesting a deferral due to health reasons, you’ll need to prepare the following documents:

- A medical certificate issued by your attending physician

- A letter of explanation written by the doctor, outlining your condition, treatment plan, and why you are unable to sit for the exam (the CFA Institute provides a standard template for this)

These documents must be uploaded through a designated CFA submission form. Once submitted, the request is reviewed by the Institute’s medical consultant team within three business days, and they will notify you whether your deferral has been approved.

In my case, the CFA Institute acknowledged that my condition met the criteria for deferral, but it did not qualify for a fee waiver. As a result, I was required to pay a $300 rescheduling fee. Fortunately, my surgery was covered by insurance, so I was able to manage the additional expense without financial strain.

If you’re facing unforeseen health or life challenges, don’t blame yourself or fall into anxiety — the CFA system does allow room for flexibility and support. The key is to ensure that you have all the required documentation and submit your application as early as possible.

However, if you’re thinking about deferring simply because you feel underprepared, I urge you to evaluate the decision carefully. Deferral is not a magic solution. Only consistent effort and follow-through will ultimately increase your chances of passing the exam.

When You’ve Overprepared

The term “overprepared” here doesn’t refer to anxious, obsessive cramming. Rather, it describes a rational yet disoriented state — where you’ve already reached a solid level of readiness, but still find yourself feeling uncertain or lost.

This experience is especially relevant for candidates who:

- Have a clear understanding of their strengths and weaknesses

- Score consistently well on mock exams

- And have a good grasp of the overall material

Despite these indicators of readiness, you may still feel unsettled — unsure of what else to focus on, or worried that you’re overlooking something critical. If that sounds like you, the next section may offer helpful insights into how to regain clarity and confidence in the final stretch.

During my CFA Level 2 preparation, I personally encountered this exact situation. I began studying in August 2023 and continued through April 2025. Although there was a four-month gap (from October 2024 to February 2025) due to surgery, work commitments, and the Lunar New Year, I still had more than enough overall study time.

By early May 2025, I started to feel a strange sense of uncertainty about what to do next. This feeling came from two main sources:

- I had already completed most of my study goals

- I had spent so much time reviewing the same materials that I could no longer tell whether I was truly understanding and able to apply the concepts, or merely recalling the correct answers from memory

I had experienced something similar in the past with shorter, more flexible certifications like the PMP. In those cases, once I felt prepared, I could simply schedule the exam and get it over with. But the CFA Program is a fixed-schedule, long-cycle exam, and even when you’re at your peak readiness, you may still have to wait weeks — or even months — to sit the test. That waiting period can lead to a frustrating sense of stagnation.

What eventually helped me was shifting my attention away from studying for a short period, and returning to it with a refreshed mindset. Specifically, at the end of April, I began more intensive physical rehab exercises, and added activities like listening to music and doing guided meditations. These breaks allowed me to step out of the constant loop of “work → CFA study → mock exam → back to work” and give my mind new forms of stimulation. It was a kind of mental reset that proved incredibly helpful.

That said, it’s important to clarify: this isn’t about breaking your study rhythm or giving up. It’s about introducing intentional variation to prevent burnout. Once I recalibrated my mental state, I was able to return to the materials with more focus and clarity — and a renewed sensitivity for absorbing and applying the content.

Final Reflections

Looking back at my Level 1 preparation, I can confidently say that Level 2 presented a much greater challenge. Fortunately, I was able to stay the course, complete the entire curriculum, and pass the exam on my first attempt — achieving the result I had hoped for.

I had mentally prepared myself for the possibility of retaking the exam, so on July 1, when the results were released, I wasn’t in a rush to check. At the time, I happened to be setting up for a live-streamed event for the AI community, and had decided not to look — until I accidentally opened Gmail and saw the subject line: “Congrats.” In that moment, I felt an overwhelming sense of joy and relief. Thankfully, that positive emotion didn’t disrupt the event or affect the speakers and audience — it only added a quiet boost of happiness.

Among all the topics in Level 2, I found derivatives the most intellectually stimulating — though ironically, it was also one of the sections where I scored lower. Areas like corporate finance, equity valuation, and financial reporting go deeper than in Level 1, and I found that this level of depth encouraged me to think more critically about the structure of annual reports — especially how to produce financial statements that reflect high earnings quality and strong reporting quality, offering true value to the shareholders of a company.

The classes also stood out for their practical insights. Our instructor didn’t just explain the theories — he invested time in sharing background context and real-world case studies, helping us better connect abstract financial concepts to the realities of the market. These references added clarity and left a lasting impression.

Ultimately, this journey deepened my appreciation for what it takes to communicate financial value — how to craft an annual report that reflects both financial integrity and strategic vision, so that shareholders can genuinely see the company’s worth.

I’m deeply grateful to the instructors whose dedication made this learning experience so rich and impactful. Their thoughtful explanations and practical examples helped bridge the gap between theory and practice, and expanded my understanding of the financial world.